Complete Civil & Construction Group Pty Ltd

The perfect fit

Complete Civil & Construction Group Pty Ltd is a Sunshine Coast based contractor for highways and defense project projects. Owner Nathan Roon was missing out on large jobs because he didn’t have the upfront cashflow.

So Nathan chose invoice finance with ABL, a comprehensive solution that provided consistent cashflow to buy more material, be more on the go and move quicker during the project tendering process.

“ABL Corp were the perfect fit – they gave us flexibility. They understood our different constraints, dramas and that we operated on a different landscape. Now we can earmark our projects and be pickier about who we work with due to having no cash flow constraints. Now we have no constraints and we have upped our returns significantly.” – Nathan Roon

Lockyer Valley Waste Management

No one does it better

Lockyer Valley Waste Management is a South East Queensland based company providing liquid waste, timber harvesting transporting, sawmilling, and mining industry services. Owner John Schollick was missing out on a lot of opportunities due to not having the right equipment because of poor cash flow.

John was frustrated by the poor banking organisations regime and to get his business back on track he chose a invoice finance solution which also enable access to equipment finance with ABL. He wanted the make his business grow without fallback hassles.

“I’ve been in business 58 years, and no one does it better than ABL Corp. They’ve got a big fan in me as they are professional, quick and always there to help us. Whatever we need it’s done. I have not only built a professional relationship with them but also a friendship one. Since we started using them, we have had a 55% increase in turnover. We’re aiming for 100% this year and we’ll get it.” –John Schollick

Country Wide Signs

Helped massively with upfront costs

Country Wide Signs is a Brisbane based company who install commercial signs Australia wide. Owner Levila Ham had a vicious cycle on her hands – customers were not paying on time and cashflow was a big problem.

Levila needed the right cashflow solution to finance the jobs upfront, because a lot of the large projects needed it. So she chose invoice finance with ABL as her solution.

“Wow the impact was immediate. From day one our financing arrangement with ABL Corp helped massively with upfront costs, out of town jobs and kept everything onsite moving forward smoothly. Our cash flow problems are now a thing of the past and this has unlocked so many more opportunities. We secure all the big jobs easily and it’s all thanks to ABL Corp.” –Levila Ham

Alltype Diesel Services

Now running on good cash flow

Alltype Diesel Services is a Sunshine Coast based company who specialise in servicing/repairing/modifying trucks and trailers. Owner Trish did not have the cashflow to purchase parts for her business and so the ongoing viability of her business was in jeopardy.

Trish did her research before contacting ABL Corp for advice on the best solution. She was impressed by the transparency of ABL and so moved forward with invoice financing to provide better cashflow for her business.

“The running of our business day-to-day is so much easier now. Before we would worry and stress about when our clients would pay us – not to mention a large amount of time spent chasing them to pay. We now have funding on invoices as we do the jobs, and this has alleviated our cash flow problems. Our business is now running on good cashflow, and we continue to grow because of this.” –Trish

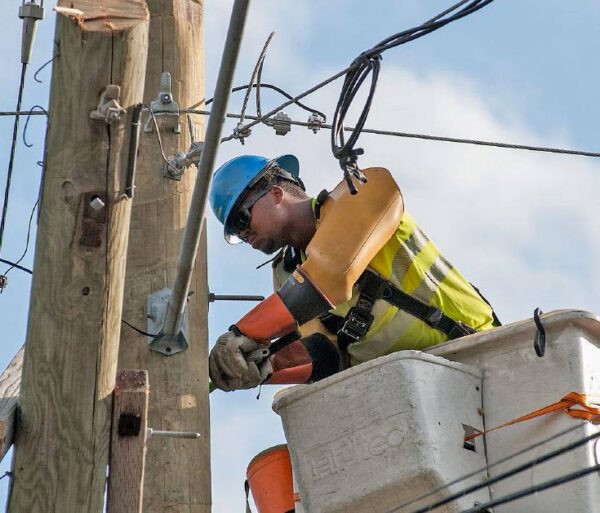

Tiger Tail Electrical & Construction

Too difficult to trade without it

Tiger Tail Electrical & Construction Pty Ltd is a Brisbane based and part of the building equipment contactors industry. Owner Mark was proudly ABL’s first client and needed ongoing support managing finance and cashflow to continue running his business.

Mark had previous many previous dealings with ABL Corp and jumped onboard with their invoice finance solution when he realised how quickly it could resolve his cashflow issues.

“We now get a return on each invoice, and this has allowed us to get funds from each invoice to continue trading when we wouldn’t otherwise be able to do so. Our business (like any) thrives off cashflow to grow – and so we don’t just see ABL Corp as another credit provider – they are our new business partner for life. Our future is now very bright and it’s all thanks to ABL Corp.” –Mark Angus